- Key Insights

- Regional Analysis of GDP Rates Among Provinces Across Canada

- Total Employment by Industry in Halifax

- Demographic Composition of Halifax’s Economic Profile

- Costs and Consequences of Slowing GDP

- Interventions and Solutions to Slowing GDP in Canada and Halifax

- The Future of Halifax’s Economy

- References

Key Insights

| The Halifax Partnership reports that from 2015 to 2024, the city’s real GDP increased by 26.5%, from $19.6 billion to $24.8 billion. Data from Halifax’s Economic Dashboard shows that health care and social assistance is the largest sector in Halifax, employing 41,900 people in 2025. According to Statistics Canada in 2021, working adults accounted for 65% of Halifax’s total population. The same report also reveals that growth in the city was supported by a 62% increase in migrant workers, who added to the labor force. RBC Economics reveals that in 2019, the productivity gap between Canada and the U.S. stood at roughly $20,00 per worker. |

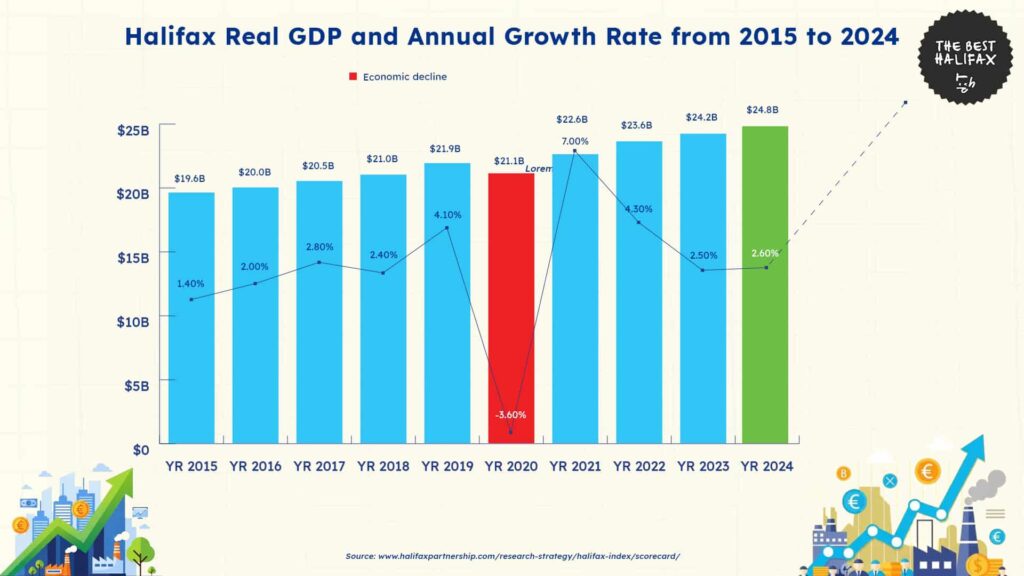

Based on data from the Halifax Partnership, Halifax’s real GDP between 2015 and 2024 increased from $19.6 billion to $24.8 billion, representing an overall increase of 26.5%.

Starting with 2015’s GDP of $19.6 billion, there was already an increase of 1.4% from the previous year.

This rise was followed by continued momentum in 2016, as GDP climbed to $20.0 billion, representing a 2.0% growth.

By 2017, Halifax’s economy advanced further to $20.5 billion. This 2.8% rise showed a growing consistency in annual gains, likely driven by stable employment, public sector activity, and urban development.

Economic expansion remained positive in 2018, with GDP growing by 2.4% to $21.0 billion. That year’s performance, although slightly slower than 2017, maintained the city’s upward trajectory.

The following year, 2019, saw stronger performance, with GDP rising to $21.9 billion, representing a 4.1% increase. This is also the highest growth rate in the five years leading up to the pandemic.

In 2020, however, the pandemic disrupted this pattern. Halifax’s GDP dropped to $21.1 billion, contracting by 3.6%.

Moreover, this decline wiped out nearly a year’s worth of growth, representing a $800 million loss in economic output. It was the only year in this entire period to register negative growth.

Recovery for the city was fairly swift since in 2021, GDP rebounded to $22.6 billion, which is a 7.0% increase and the highest single-year growth rate in the entire period.

The sharp rise was likely driven by the resumption of economic activity across all industries in the city.

By 2022, real GDP rose again to $23.6 billion. While the pace slowed to 4.3%, this still represented a consistent recovery after the pandemic.

Economic expansion continued in 2023, reaching $24.2 billion, though the growth rate once again slowed down to 2.5%.

In 2024, Halifax saw an increase of $600 million in economic output, reaching $24.8 billion with a slightly higher growth rate of 2.6%.

Looking forward, Halifax has set a target of $26.3 billion in GDP by 2027. Reaching this goal would require an average annual growth rate of just over 1.9% from 2024 to 2027.

Based on the city’s performance in recent years, this trajectory appears within reach, provided economic conditions remain stable.

Regional Analysis of GDP Rates Among Provinces Across Canada

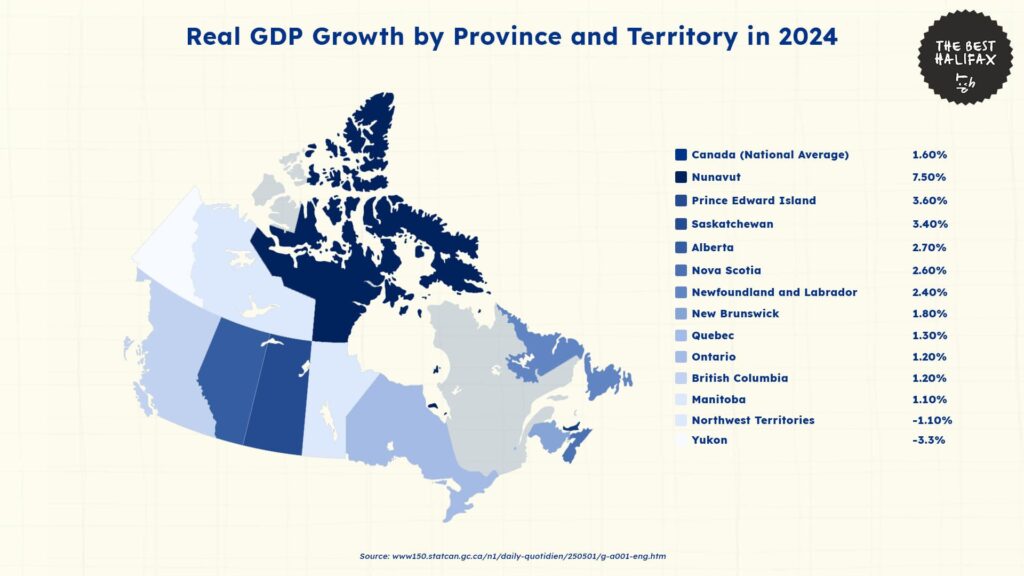

Statistics Canada shows that in 2024, Nova Scotia recorded a real GDP growth rate of 2.6%.

This performance placed the province well above the national average of 1.6% and ahead of many of Canada’s most populous provinces.

Among the four Atlantic provinces, Nova Scotia was the second strongest performer.

Prince Edward Island led the region with a 3.6% growth rate, outperforming Nova Scotia by 1.0 percentage point. Newfoundland and Labrador followed at 2.4%, while New Brunswick reported 1.8%.

In central Canada, Ontario’s GDP increased by 1.2%, placing it 1.4 percentage points below Nova Scotia. Quebec fared slightly better at 1.3%, but still grew at only half the rate of Nova Scotia.

Across Western Canada, Alberta posted a 2.7% growth rate, narrowly surpassing Nova Scotia by just 0.1 percentage point.

Saskatchewan recorded a growth rate of 3.4%, placing it among the top three provincial performers for the year.

Meanwhile, Manitoba lagged behind with only 1.1% growth, which is less than half the rate of Nova Scotia.

British Columbia reported 1.2% GDP growth in 2024. This result placed it at the same rate as Ontario and behind Nova Scotia by 1.4 percentage points.

As for the territories, Nunavut experienced the strongest economic growth in the country at 7.5%.

This figure was nearly three times higher than Nova Scotia’s rate of 2.6%, which indicates more economic resilience in the province.

In contrast, both the Northwest Territories and Yukon reported economic slowdowns.

The Northwest Territories saw a GDP decline of 1.1%, while Yukon’s rate also dropped by 3.3%, meaning that both were the only provinces with a drop in GDP.

Overall, only four provinces or territories surpassed Nova Scotia’s growth rate in 2024, which were Nunavut, Saskatchewan, Prince Edward Island, and Alberta.

This positions Nova Scotia close to the top of the list of Canadian provinces for economic growth, which shows that it had a stronger performance than most of the provinces throughout the country.

Total Employment by Industry in Halifax

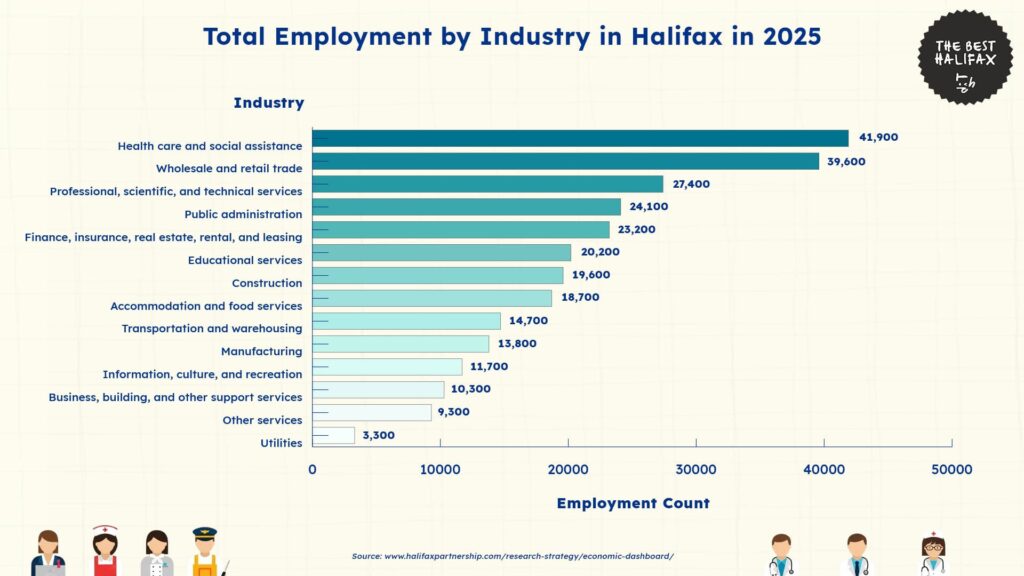

Halifax’s Economic Dashboard shows that in 2025, the city’s labor force was concentrated in service-oriented sectors, with the majority of jobs found in health care, retail, education, and government-related fields.

Health care and social assistance employ 41,900 people, making it the largest sector in Halifax. Ongoing hospital expansions, aging population needs, and community health programs continue to drive workforce demand for this industry.

Following this, the wholesale and retail trade industry comes in second place with a total of 39,600 employees.

Retail remains a vital part of Halifax’s economy, with shopping centers, local businesses, and supply networks contributing to steady employment throughout the city.

Meanwhile, professional, scientific, and technical services account for another 27,400 workers. This includes lawyers, engineers, accountants, architects, and IT professionals.

Growth in this sector suggests rising demand for high-skill, knowledge-based work in the city.

Furthermore, public administration counted 24,100 jobs. As Nova Scotia’s capital city, Halifax is home to provincial departments, federal agencies, and municipal offices, which creates a higher demand for labor in this industry.

Finance, insurance, real estate, rental, and leasing employ another 23,200 people. The city’s real estate boom and the presence of regional financial institutions contribute to the continued strength of this sector.

Similarly, educational services provide jobs to 20,200 individuals. Major educational institutions contribute to this workforce, with additional employment found in public schools and private training colleges.

Next to this, the construction industry employs 19,600 workers, reflecting the city’s rapid growth in residential, commercial, and public infrastructure projects. Demand for labor here has also been sustained by housing development and road expansion projects.

Accommodation and food services support an additional 18,700 jobs. The industry is driven by Halifax’s tourism season, cruise port traffic, and a growing culinary and hospitality scene in urban centers.

Transportation and warehousing add another 14,700 workers. Halifax’s port operations, logistics firms, and public transit networks make this sector critical to the regional supply chain and mobility.

On the lower end of the list, the manufacturing industry accounts for 13,800 jobs. Core services here include shipbuilding, aerospace components, and food processing.

Information, culture, and recreation employ 11,700 people. This group includes workers in libraries, museums, entertainment venues, media, and fitness centers.

Business, building, and other support services total 10,300 jobs. However, this sector showed a notable drop in employment, possibly due to outsourcing or automation trends in administrative and janitorial services.

Other services employ 9,300 people. This general category includes repair services, religious organizations, and personal care providers.

Finally, utilities have the smallest workforce at 3,300. These workers manage energy distribution, water supply, and power systems.

Demographic Composition of Halifax’s Economic Profile

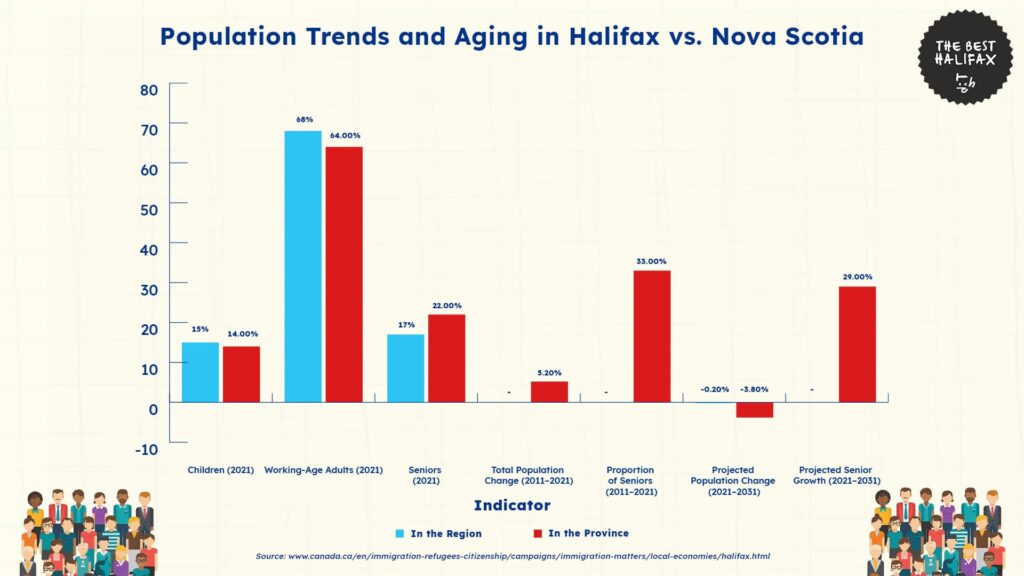

Age Trends

Statistics Canada gives insights into the economic profile of the working population and residents in Halifax, in comparison to the whole of the province.

As of 2021, Halifax maintained a younger and more workforce-oriented population than the rest of Nova Scotia.

Children under 15 made up 15% of the population in the region, which is slightly above the provincial figure of 14%.

Meanwhile, working-age adults accounted for 68%, which is a full four percentage points higher than the provincial average of 64%.

Seniors made up only 17% of Halifax’s population, significantly lower than the 22% recorded across the province.

Between 2011 and 2021, Halifax’s total population rose by 19%, far surpassing the 5.2% increase recorded province-wide.

However, the city’s demographic structure also shifted, which affects the working population.

The proportion of children declined by 2.5%, while the share of working-age adults fell by 5.4%. At the same time, the senior population rose sharply by 33%, matching the provincial trend.

Without continued immigration, these dynamics could change drastically. By 2031, the region’s total population could decline slightly by -0.2%, while the province would see a more substantial drop of 3.8%.

The share of children would also fall by 7.5%, and the working-age population would decline by 7.0%. Meanwhile, the proportion of seniors would grow by another 34%, further increasing the gap in this ratio.

Overall, this shows how the city’s economic output could be affected by an aging population and shrinking workforce.

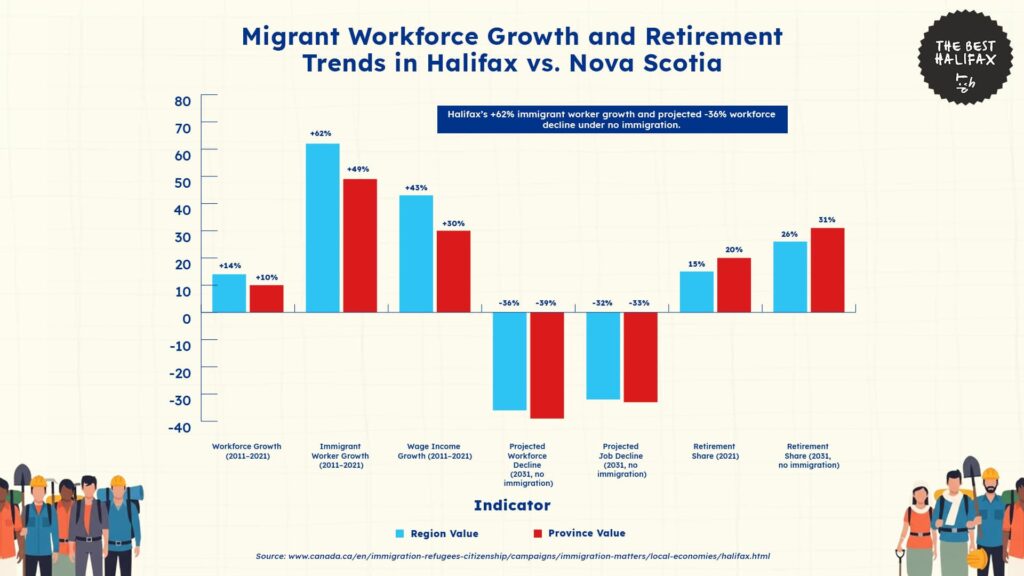

Migrant Labor Trends

In 2021, Halifax’s growth was supported by a 62% increase in immigrant workers, which reflects the city’s success in attracting newcomers and integrating them into the labor force. Across the province, immigrant worker growth was slightly lower at 49%.

Along with this, total employment income in the city increased by 43% over the decade, while provincial growth was only at 30%.

This shows that the city not only has more jobs but also higher-paying ones, particularly in health care, education, professional services, and construction.

Growth in these sectors was driven by an increase in migrants to the city, which significantly boosts its labor force.

However, despite these gains, demographic pressures remain an issue for Halifax. In 2021, retirees made up 15% of Halifax’s workforce, compared to 20% in the province.

Moreover, projections show this figure rising to 26% by 2031 under a no-immigration scenario. The same scenario also predicts a 36% decline in the region’s overall workforce and a 32% drop in the number of jobs.

Thus, these projections reinforce the importance of immigration to Halifax’s economic future. Without immigrants, the city could face labor shortages, compounding job losses, and stalling economic growth.

Costs and Consequences of Slowing GDP

RBC Economics gives insights into how Canada’s declining productivity growth has had wide-ranging consequences, affecting everything from individual wages to national investment performance.

While GDP continues to grow in absolute terms, per-capita output has stalled since 2019 and remains below pre-pandemic levels when adjusted for inflation and immigration.

For Halifax and similar regional economies, this overall national stagnation is beginning to constrain long-term economic potential.

For one, Canada’s economy is now smaller on a per-person basis than it was in 2019. This stagnation limits wage growth and reduces the fiscal space available for public services.

The productivity gap between Canada and the U.S. stood at roughly $20,000 per worker, translating into wages that are approximately 8% lower than those of American workers.

Household prosperity is directly tied to this gap. Slower productivity growth means lower real incomes for those in Halifax, where rising costs of living are not being matched by comparable income gains.

Over time, this reduces consumer purchasing power and increases household debt burdens.

One of the most visible effects of slowing GDP growth is poor investment performance.

A Canadian investor who put $1,000 into the main stock index in 2000 would have around $4,400 today. In contrast, the same investment in the U.S. S&P 500 would be worth approximately $6,000, which is a 35% difference.

These capital gaps reflect slower economic expansion, lower business earnings, and weaker investor confidence.

Moreover, the investment shortfall is not only private. Public infrastructure renewal has lagged, particularly in ports, transit, and digital networks.

For cities like Halifax, which rely on trade and service-sector employment, delayed infrastructure investments increase congestion, lower efficiency, and limit the growth potential of key sectors.

Canada’s economy has also suffered from the deindustrialization of key regions. Manufacturing is now half the share of GDP it was in 2000, and investment in intellectual property and advanced technology remains below OECD averages.

In Halifax, this limits high-value job creation, pushing more employment toward lower-productivity service roles.

Natural resource sectors such as oil and gas, once major growth drivers, are seeing structural decline due to global energy transitions.

Meanwhile, mining and energy investment also remain subdued, affecting the economic health of related industries like equipment manufacturing and transport logistics.

Furthermore, Canada’s economy is heavily reliant on small businesses, but many of these are less productive than their international peers.

A lack of capital investment, red tape across jurisdictions, and skill mismatches further hinder expansion. Halifax, where small businesses form a major part of the local economy, is especially vulnerable to these pressures.

The slow pace of new business formation and limited scale-up opportunities restrict innovation and employment growth. This, in turn, impacts government revenues, slows wage increases, and weakens economic resilience.

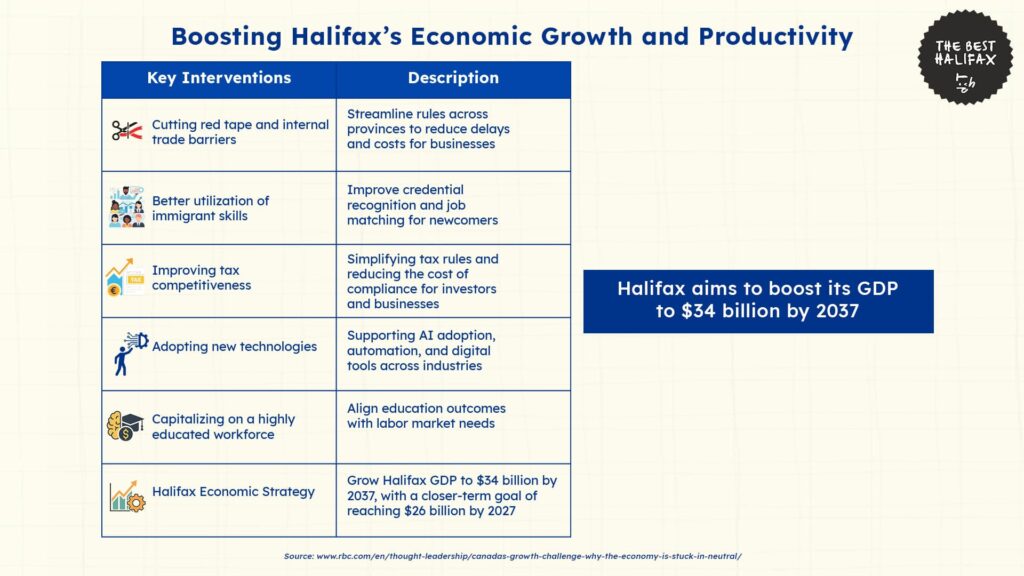

Interventions and Solutions to Slowing GDP in Canada and Halifax

An article by RBC Economics gives insights into how to reverse the effects of Canada’s slowing productivity and unlock long-term economic growth through identifying a range of targeted interventions.

One of the most immediate priorities is cutting red tape and reducing internal trade barriers, which currently drive up costs and delay investments by adding administrative burdens across provinces.

Streamlining regulations and harmonizing approval processes could help accelerate project timelines and improve business efficiency.

Another key area is better utilization of immigrant skills.

As immigrants now account for a portion of the labor force in Canada, ensuring newcomers can access jobs that match their qualifications is critical to boosting workforce productivity, especially in growing cities like Halifax.

Improving tax competitiveness is also essential. While Canada’s overall tax burden is comparable to other advanced economies, the complexity of tax compliance remains a deterrent for businesses.

Simplifying the tax system and reducing the cost of capital could help attract more domestic and foreign investment.

At the same time, adopting new technologies such as artificial intelligence and advanced software tools is necessary to raise output per worker.

Despite Canada’s innovation potential, AI adoption rates remain low, which limits productivity gains across industries.

Finally, Canada must capitalize on its highly educated workforce by ensuring that education translates into labor market outcomes.

With a growing number of post-secondary graduates, especially in urban centers, aligning educational investments with economic needs can help drive a more efficient, knowledge-based economy.

These solutions can help enable Canada and regions like Halifax to grow not just by adding more people, but by increasing the value created by every worker.

Thus, in response to long-term economic challenges, Halifax has developed a localized plan to guide inclusive, sustainable growth through 2027.

The Halifax Regional Municipality and Halifax Partnership collaborated on the Inclusive Economic Strategy 2022–27, with input from over 2,500 residents, business leaders, and community stakeholders.

Centered on the theme “People. Planet. Prosperity.”, the strategy aims to ensure that all residents benefit from the city’s economic expansion.

The vision sets bold targets of growing GDP to $34 billion and population to 650,000 by 2037, with a nearer-term goal of reaching $26 billion in GDP and a population of 525,000 by 2027.

Strategic priorities for Years 3–5 (2024–2027) include promoting inclusive growth, attracting and retaining talent, and enhancing quality of life.

Specific initiatives include supporting entrepreneurship, expanding housing supply, strengthening arts and culture, improving business permitting, and welcoming immigrants with tailored settlement services.

The Future of Halifax’s Economy

Halifax is well-positioned for continued economic expansion over the next several years, provided current momentum is sustained and strategic interventions are effectively implemented.

Based on recent trends and targets set in the city’s economic strategy, Halifax’s real GDP is expected to grow from $24.8 billion in 2024 to $26 billion by 2027, with further expansion to $34 billion by 2037.

Population growth is also expected to remain strong, with projections pointing to 525,000 residents and a labor force of 310,000 by 2027.

Continued immigration will be critical to meeting these goals, especially as natural population growth slows and retirement rates rise.

If immigration flows are maintained and workforce participation remains high, Halifax may avoid the steep labor shortages projected under no-immigration scenarios and instead see steady job creation, wage growth, and productivity gains.

Additionally, targeted efforts to improve housing availability, support business growth, and streamline public infrastructure could enable Halifax to outperform national averages in economic resilience.

With these elements in place, Halifax is on track to meet its economic goals and achieve continued GDP growth.

References

- Halifax Partnership. (n.d.). Halifax index: Scorecard. https://halifaxpartnership.com/research-strategy/halifax-index/scorecard/

- Statistics Canada. (2025, May 1). Real gross domestic product growth, Canada, provinces and territories, 2024. https://www150.statcan.gc.ca/n1/daily-quotidien/250501/g-a001-eng.htm

- Halifax Partnership. (n.d.). Economic dashboard. https://halifaxpartnership.com/research-strategy/economic-dashboard/

- Immigration, Refugees and Citizenship Canada. (n.d.). Immigration matters in Halifax. Government of Canada. https://www.canada.ca/en/immigration-refugees-citizenship/campaigns/immigration-matters/local-economies/halifax.html

- Royal Bank of Canada. (n.d.). Canada’s growth challenge: Why the economy is stuck in neutral. https://www.rbc.com/en/thought-leadership/canadas-growth-challenge-why-the-economy-is-stuck-in-neutral/

- The Conversation. (2024, May 21). Canada is falling behind its peers in terms of living standards — can it catch up? https://theconversation.com/canada-is-falling-behind-its-peers-in-terms-of-living-standards-can-it-catch-up-228271

- Halifax Partnership. (n.d.). Halifax economic strategy. https://halifaxpartnership.com/research-strategy/halifax-economic-strategy/

- Halifax Partnership. (2024). People. Planet. Prosperity: Halifax inclusive economic strategy 2022–27 (Years 3–5 Snapshot). https://halifaxpartnership.com/sites/default/uploads/People.Planet.Prosperity.Halifax-Inclusive-Economic-Strategy-2022-27-Years-3-5-Snapshot.pdf

- Nova Scotia Department of Finance and Treasury Board. (n.d.). Nova Scotia statistics. https://www.novascotia.ca/finance/statistics/

- Statista. (n.d.). Monthly gross domestic product of Canada by industry. https://www.statista.com/statistics/594293/gross-domestic-product-of-canada-by-industry-monthly/