- Key Insights

- Remote Work Trends in Halifax

- Regional Analysis of Unemployment Trends in Nova Scotia

- Industry Employment Trends in Halifax

- Demographic Breakdown of Unemployment Trends in Halifax

- Costs and Consequences of High Unemployment Rates

- Interventions and Solutions to High Unemployment Rates in Halifax

- The Future of Halifax’s Job Market

- References

Key Insights

| The Halifax Index 2024 reports that Halifax’s total employment grew from 221,300 in 2014 to 263,600 in 2023, adding 42,300 jobs over nine years. Job Bank data indicates that Halifax had the lowest unemployment rate in Nova Scotia at 4.6%. Research by the Canadian Mental Health Association links unemployment to increased health risks, showing that a 10% rise in unemployment leads to nearly a 2% increase in deaths from heart disease. Data from the Halifax Index shows that wholesale and retail trade was Halifax’s largest employment sector in 2023, with 39,900 workers. Statistics Canada reveals that the general unemployment rate for individuals aged 15 and older was 5.5%. |

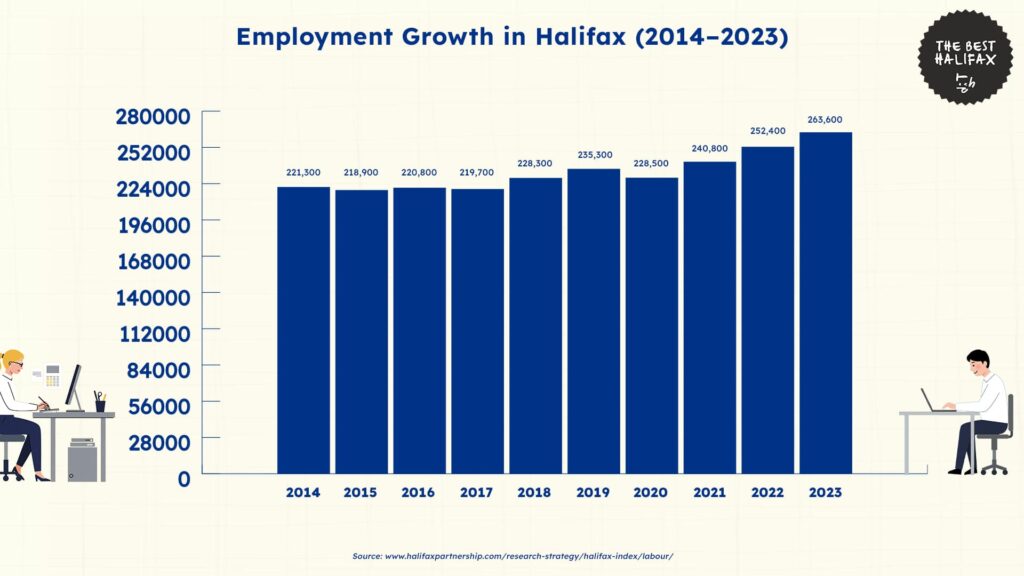

The Halifax Index 2024 shows that between 2014 and 2023, Halifax’s total employment increased from 221,300 to 263,600. This indicates a gain of 42,300 jobs over a period of nine years and an overall employment growth of 19.1%.

Although Halifax’s job market showed growth in the long term, this trend was not linear. For example, employment declined slightly from 221,300 in 2014 to 218,900 in 2015, which was a 1.1% decrease.

The numbers also fluctuated in the following years, reaching a lowest point of 219,700 in 2017 before rising again to 228,300 in 2018. This is a 3.9% increase and indicates some recovery during this period.

From 2018 to 2019, employment grew by 3.1%, reaching 235,300.

However, in 2020, employment dropped to 228,500, which is a 2.9% decrease from the previous year. This decline was likely due to the economic disruptions of the COVID-19 pandemic.

The following years then saw some recovery, with employment increasing to 240,800 in 2021, which is 5.4% growth from 2020. This growth was caused by the reopening of the economy and increased hiring across different industries,

This rate then further climbed to 252,400 in 2022, which is a 4.8% growth from 2021, and 263,600 in 2023 – another 4.4% growth. These consecutive periods of growth indicate a positive trend in Halifax’s labor market.

Remote Work Trends in Halifax

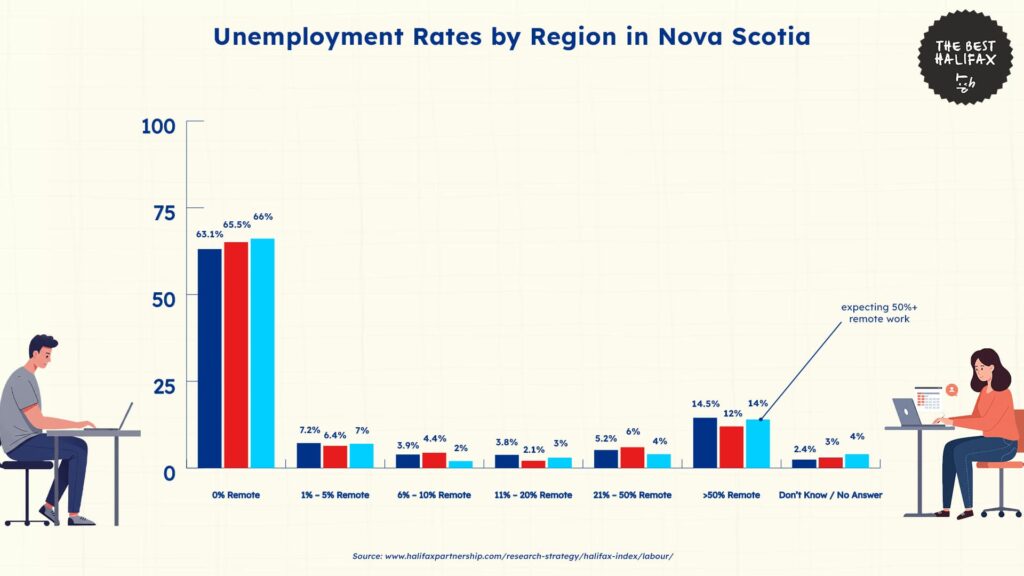

Data from the Halifax Index gives insights into remote work trends in the city.

Remote employment in Halifax has been steady between 2022 and 2024, with minimal changes. While some businesses continued to support remote work even after the pandemic, most still preferred onsite setups.

In 2024, 66.1% of companies indicated having 0% remote workers, compared to 65.5% in 2023 and 63.1% in 2022. This large percentage shows that most companies do not support remote working arrangements.

Meanwhile, the percentage of companies with 1% to 5% of their employees working remotely was 6.9% in 2024, which was down slightly from 6.4% in 2023 and 7.2% in 2022.

This decline in remote work comes after the COVID-19 pandemic, as people returned to their offices.

Similarly, the number of companies with 6% to 10% remote staff was 2.2% in 2024, down from 4.4% in 2023 and 1.9% in 2022. This further demonstrates the shift away from remote working arrangements.

On the other hand, companies with 11% to 20% remote work was 2.7% in 2024, up from 2.1% in 2023 but lower than 3.8% in 2022.

Companies with 21% to 50% of their employees working remotely comprised 4.3% of the population in 2024, declining from 6.4% in 2023 and 5.2% in 2022.

Finally, the percentage of companies with over 50% remote workers was at 14.0% in 2024, after declining to 11.8% in 2023 from 14.5% in 2022.

Overall, companies in Halifax still prefer face-to-face work, with some increase in remote work arrangements.

Regional Analysis of Unemployment Trends in Nova Scotia

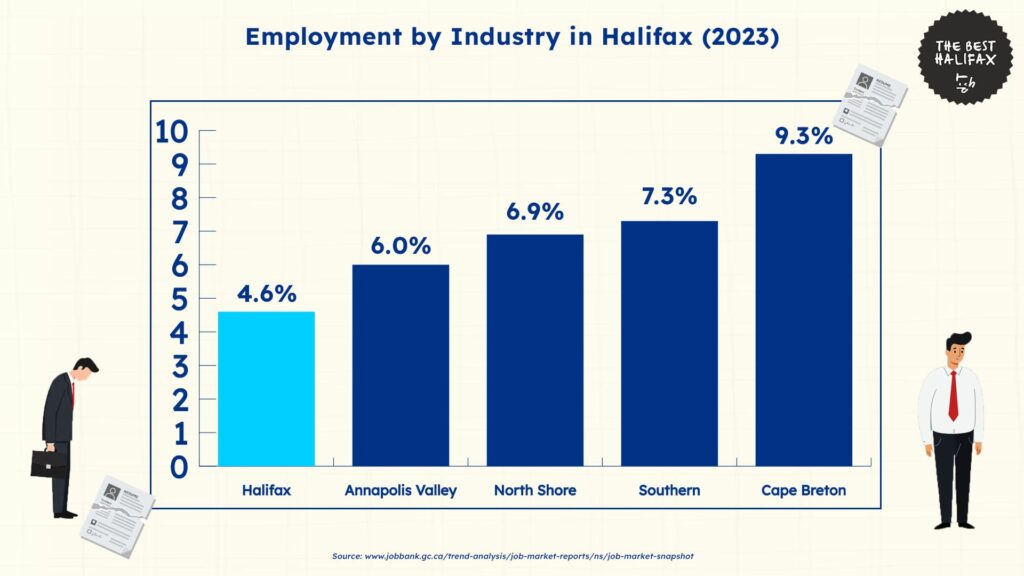

Job Bank reveals that Halifax had the lowest rate of unemployment in Nova Scotia at 4.6%, which shows better job availability and economic strength than other areas in the province.

This suggests that Halifax has a more stable labor market with greater employment opportunities for residents.

Cape Breton, on the other hand, recorded the highest rate of unemployment at 9.3% which is almost twice Halifax’s rate. This gap of 4.7 percentage points shows a major employment imbalance between the two areas.

Meanwhile, the South region experienced an unemployment rate of 7.3%, which is 2.7 percentage points above Halifax’s rate. These figures show that job market conditions remain slightly tougher in these areas.

Likewise, the North Shore region had 6.9% unemployment, which is also much higher than Halifax by a difference of 2.3 points.

Moreover, Annapolis Valley’s rate was 6.0%, which is 1.4 percentage points above Halifax. Although this rate is better than in other areas, it is still higher than that of Halifax.

Overall, the average unemployment rate across the five regions is 6.8%. Thus, Halifax’s rate is 2.2 percentage points below the provincial average, indicating that Halifax’s economy performs better than the rest of the province.

Industry Employment Trends in Halifax

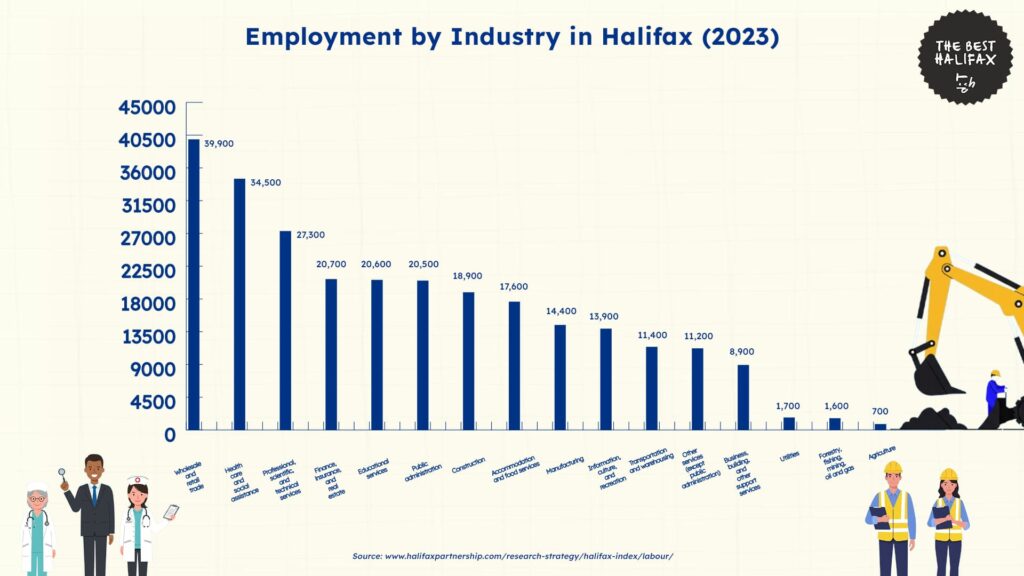

Data from the Halifax Index shows notable trends in employment across industries in Halifax.

The retail and wholesale trade industry had the most employees in Halifax in 2023, as it employed 39,900 workers. This high number reflects the sector’s significance to Halifax’s economy.

This is then followed by the health care and social assistance industry, with 34,500 workers, which indicates a strong demand for medical and social services.

Meanwhile, the professional, scientific, and technical services industry ranked third, employing 27,300 workers. This highlights strong growth in Halifax’s professional workforce.

Several other sectors had between 20,000 to 21,000 employees, namely finance, insurance, and real estate (20,700), educational services (20,600), and public administration (20,500), which all contribute to the labor market.

Next to this, the construction industry employed 18,900 workers. Another 17,600 residents were also employed in accommodation and food services.

The manufacturing industry also provided 14,400 jobs, while information, culture, and recreation contributed another 13,900.

Similarly, transportation and warehousing employed 11,400 residents and 11,200 belonged under the other services category.

Business, building, and other support services had 8,900 employees, showing a smaller but still significant presence in Halifax.

On the other hand, some sectors had far fewer workers. Utilities had 1,700 workers, forestry, fishing, mining, and oil and gas employed 1,600 workers, and agriculture had the lowest figure with just 700 workers.

These sectors accounted for a relatively smaller position in Halifax’s job market, which reflects their limited role in the city’s overall economy.

Demographic Breakdown of Unemployment Trends in Halifax

Figures from Statistics Canada reveal how unemployment disproportionately affects different groups in Halifax.

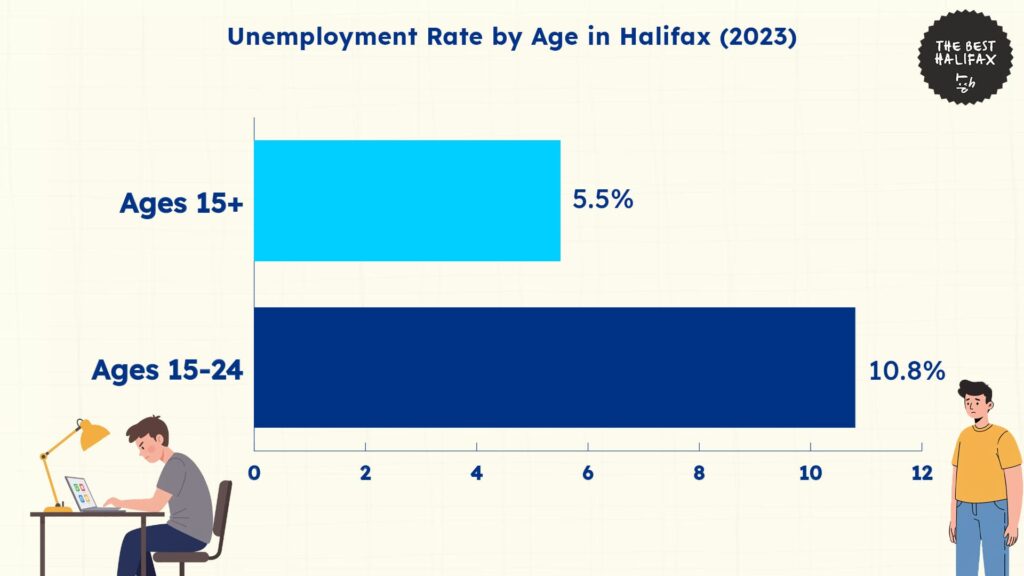

Unemployment Trends by Age Group

In 2023, Halifax’s unemployment rates differed considerably when looking at age groups.

The general unemployment rate for those 15 and older was 5.5%, which shows fairly consistent employment levels for the overall workforce.

Younger workers, however, had much more difficulty finding employment. The unemployment rate for those aged 15 to 24 was 10.8%.

This rate is almost twice the overall rate for unemployment and shows some increased job insecurity for younger workers.

Moreover, this gap indicates that youth unemployment is still a major concern in Halifax, as younger workers face issues like inadequate work experience, competition for first-time jobs, and dependence on part-time or seasonal employment.

However, it is also important to note that most young employees might also be in school, which pushes this number higher.

Unemployment Trends by Gender

In 2023, Halifax’s unemployment rates showed a small gender gap.

The male unemployment rate was 5.8%, while the female unemployment rate was 5.2%. This is a difference of 0.6 percentage points.

Although both groups had relatively low unemployment rates, men had slightly higher unemployment than women.

Given that the overall unemployment figures for both genders are still very close, this reflects a more equitable labor market in Halifax.

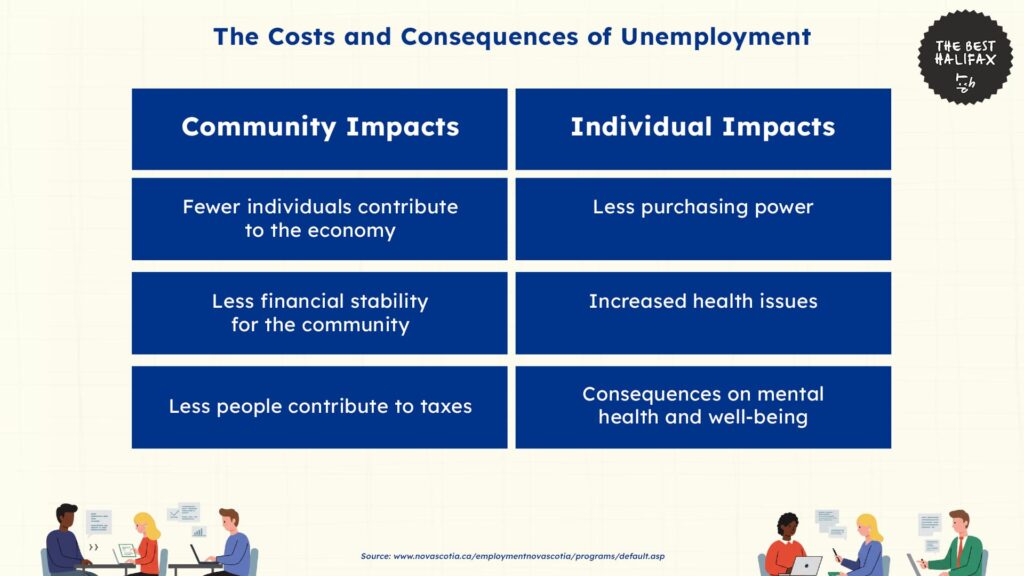

Costs and Consequences of High Unemployment Rates

Research by the Canadian Mental Health Association shows that unemployment has important economic and social implications, especially as it impacts communities and individuals.

As job loss rates in the city increase, this creates economic instability and public health challenges that have widespread effects on residents.

On a larger scale, unemployment lowers the city’s economic productivity level since fewer individuals contribute to the economy. Individuals have less purchasing power and are unable to contribute to the city’s taxes.

Beyond economic losses, the impact of unemployment also affects the general well-being of communities, as a weaker labor market means less financial stability.

For example, increased unemployment levels can cause a reduced level of life satisfaction in communities, even among those who are employed due to fears of unemployment.

Furthermore, unemployment is associated with increased health issues, and the research indicates that an increase in unemployment by 10% results in an increase in deaths due to heart disease by almost 2%.

More alarmingly, this also results in an increase in suicide rates by almost 1%, and an increase in psychiatric hospital admissions by 4%.

On an individual level, unemployment also has serious consequences for a person’s mental health and well-being.

Unemployment has been found to lead to increased stress levels, decreased self-esteem, anxiety, and social withdrawal. This is even worse for individuals with pre-existing conditions, as unemployment can worsen mental illness symptoms.

Interventions and Solutions to High Unemployment Rates in Halifax

To combat unemployment and enhance workforce participation, the Government of Nova Scotia has implemented several targeted programs aimed at providing skills development, job creation, and employment support.

The Nova Scotia Works Employment Services Centres offer career planning, job search assistance, and employer support, ensuring individuals have access to the resources needed to enter or re-enter the workforce.

For those seeking to upgrade their qualifications, the Skills Development Program provides financial assistance for tuition, books, and training-related costs. This helps unemployed individuals gain new skills to improve their employment prospects.

Meanwhile, the START Program incentivizes employers to hire job seekers by offering wage subsidies and training support, making it easier for businesses to invest in new talent.

Initiatives for entrepreneurs also exist, With the Self Employment Program supporting unemployed individuals in launching their own businesses.

This initiative provides financial aid and mentorship during the startup phase, helping participants transition from unemployment to self-sufficiency.

Additionally, the Job Creation Partnerships Program offers temporary work opportunities that benefit both participants and the community, as it allows individuals to gain meaningful work experience that enhances their long-term employability.

For those facing significant barriers to employment, the Employment Interventions initiative provides specialized, long-term assistance tailored to individual needs.

These programs offer structured support to help job seekers overcome obstacles and transition into sustainable employment.

The Future of Halifax’s Job Market

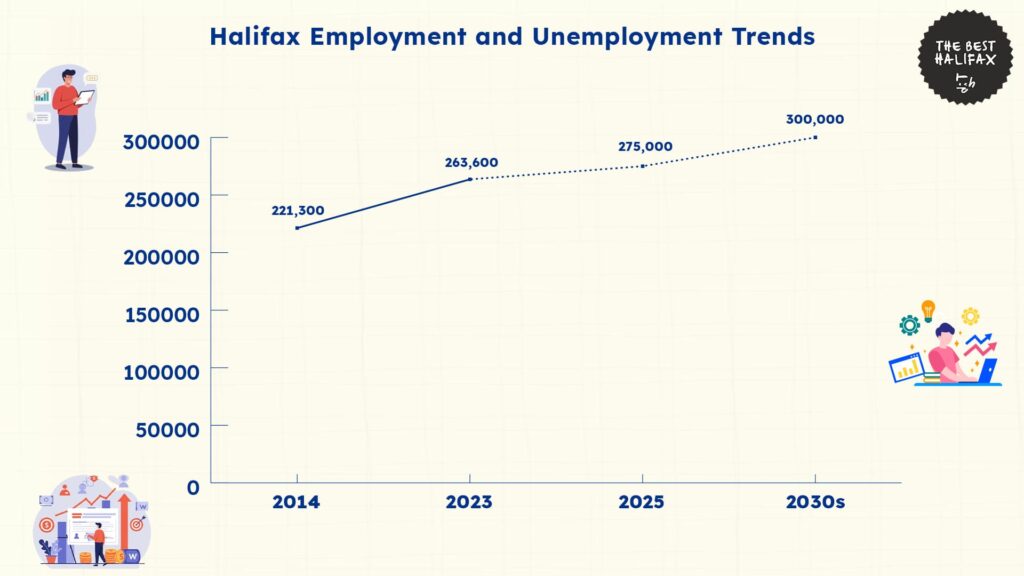

Halifax’s employment rate has increased by 19.1% from 2014 to 2023, with the creation of 263,600 jobs.

If this growth of 2.1% per year persists, overall employment will exceed 275,000 by 2025 and 300,000 by the early 2030s.

Growth will continue mostly in strong industries like health care, professional services, and finance.

However, industries with historically lower employment numbers, such as manufacturing, utilities, and agriculture, may struggle to expand.

Despite this upward trend, youth unemployment remains a concern, with individuals aged 15 to 24 facing an unemployment rate of 10.8%.

Without targeted interventions for this issue, this gap may persist. Programs such as Skills Development and START will likely play a crucial role in addressing this.

Looking ahead, Halifax’s ability to sustain job growth will depend on continued investments in workforce development and job creation initiatives.

While external economic factors such as global recessions or policy shifts could impact these projections, the overall outlook for Halifax’s job market remains positive, with continued expansion anticipated in the coming years.

References

- Halifax Partnership. (n.d.). Labour – Halifax index. Retrieved March 18, 2025, from https://halifaxpartnership.com/research-strategy/halifax-index/labour/

- Government of Canada. (n.d.). Job market snapshot – Nova Scotia. Job Bank. Retrieved March 18, 2025, from https://www.jobbank.gc.ca/trend-analysis/job-market-reports/ns/job-market-snapshot

- Canadian Mental Health Association. (n.d.). Unemployment, mental health, and substance use. Retrieved March 18, 2025, from https://bc.cmha.ca/documents/unemployment-mental-health-and-substance-use/#:~:text=Unemployment%20costs%20communities%20because%20people,being%20of%20the%20entire%20community

- Government of Nova Scotia. (n.d.). Employment Nova Scotia programs and services. Retrieved March 18, 2025, from https://novascotia.ca/employmentnovascotia/programs/default.asp

- Halifax Regional Municipality. (n.d.). Work for Halifax Regional Municipality. Retrieved March 18, 2025, from https://www.halifax.ca/about-halifax/employment/work-halifax-regional-municipality

- Government of Nova Scotia. (n.d.). Nova Scotia Works Employment Services Centres. Retrieved March 18, 2025, from https://novascotia.ca/employmentnovascotia/programs/NSWorks.asp

- Government of Nova Scotia. (n.d.). Skills Development Program. Retrieved March 18, 2025, from https://novascotia.ca/employmentnovascotia/programs/skills-development.asp

- Government of Nova Scotia. (n.d.). START Program. Retrieved March 18, 2025, from https://novascotia.ca/employmentnovascotia/programs/start.asp

- Government of Nova Scotia. (n.d.). Self-Employment Program. Retrieved March 18, 2025, from https://novascotia.ca/employmentnovascotia/programs/self-employment.asp

- Government of Nova Scotia. (n.d.). Job Creation Partnerships Program. Retrieved March 18, 2025, from https://novascotia.ca/employmentnovascotia/programs/job-creation-partnerships.asp

- Government of Nova Scotia. (n.d.). Employment Interventions and Work Activity Centres. Retrieved March 18, 2025, from https://novascotia.ca/employmentnovascotia/interventions/default.asp